Investment Strategy focused on Enterprise Software

Lower/Middle Market Focus

- Lotus is focused on companies with some combination of $1-5M in ARR/$5-20M in Perpetual.

Niche, Underserved Strategy

- Our commitment to ongoing Business Development resulted in excess deal flow for Fund II. For Fund III, Lotus has a pipeline of over 15 deals currently being evaluated.

Robust Business Development

- Lotus has expanded the GP Team to increase our network of longstanding relationships in the Enterprise Software space. These relationships are core to accelerating deal/sales/exit origination performance for both the Fund and PCs.

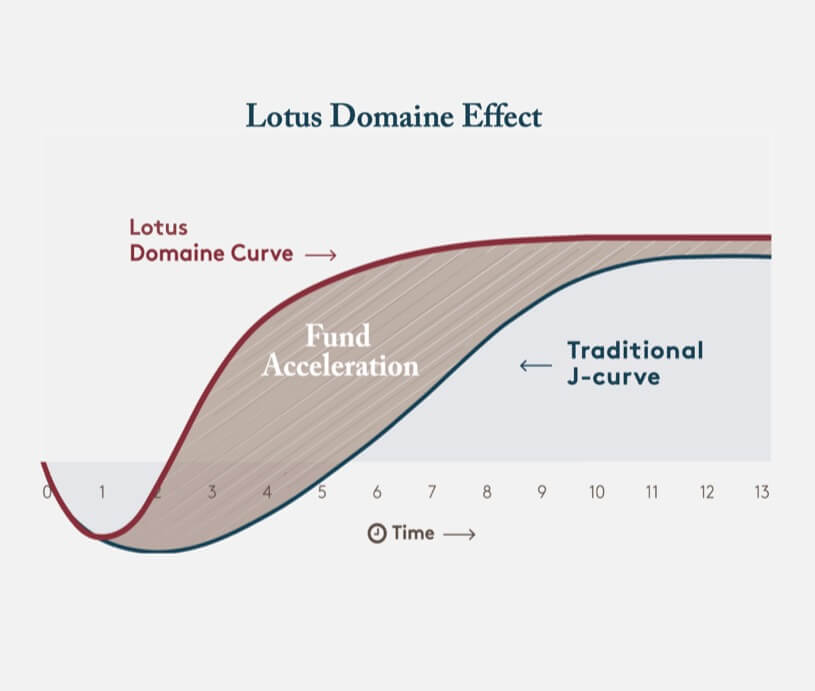

Actively managed PCs, Accelerated Outcomes

- Leadership: Ensure all key executives are familiar with Lotus and our methodology to ensure efficient execution.

- Revenue Acceleration: Focused on Process, Products, and People within PCs to accelerate marketing, business development, and sales performance

- Back Office: Implementation of best practices and workflows within PCs to streamline Finance, IT, and HR.

- Timely Exits: Once KPIs (e.g. profitability, license model conversion, revenue, and sales booking growth, etc.) are accomplished, Lotus focuses on harvesting the PC, while the BD team finalizes the positioning for Exit

Stay in the loop

Sign up to receive regular updates and information.

Error: Contact form not found.

Modal title

Thank you

Your submission has been received.

We will contact you soon!

We will contact you soon!